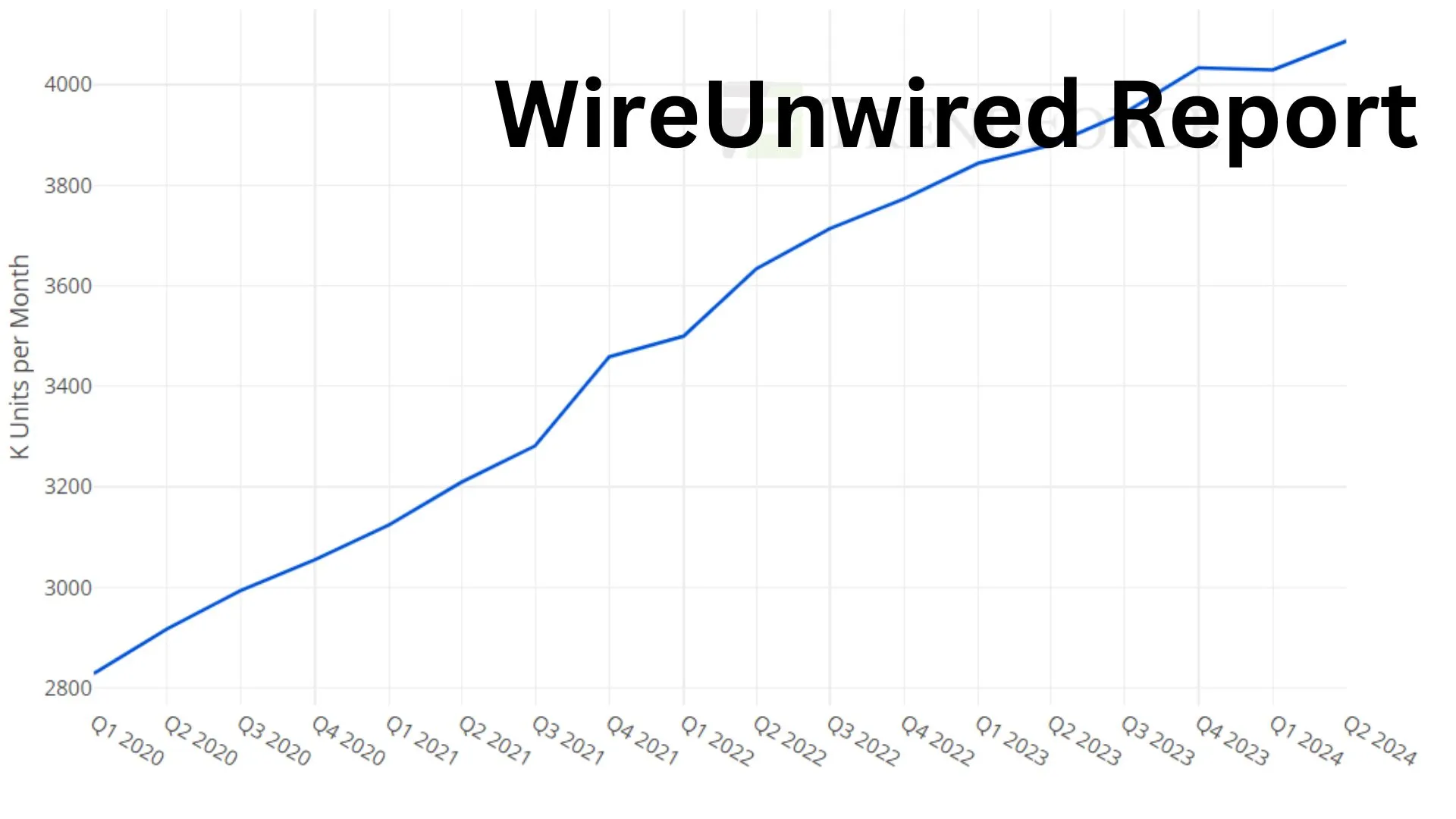

The global semiconductor foundry capacity has seen unprecedented growth over the past five years. From a capacity of 2,828.53 thousand wafer starts per month (kWSPM) at the end of 2019 to 3,993.27 kWSPM by the second quarter of 2024, the global semiconductor foundry has seen a whopping growth of over 41%.

But not all foundries have grown significantly during this period.With TSMC leading the foundry business, others are still trying to catch up. With giant players like Intel and Samsung struggling to keep their businesses going, the whole foundry business is seemingly TSMC-dominated.

Table of Contents

ToggleKey Drivers Behind Global Semiconductor Foundry Capacity Expansion

1)Technological Advancements Across Sectors:

- Consumer Electronics: Smartphones, laptops, and gaming consoles have seen a next level of growth in the past 5 years. This unexpected growth has led to increased demand for advanced process nodes like 5nm and 3nm accelerating production. Devices such as Apple’s iPhones and gaming GPUs drove bulk orders from foundries.

- Automotive Industry: The rise of electric vehicles (EVs) and autonomous technologies propelled the need for specialized chips for battery management, sensors, and AI-driven systems. Automotive chips now constitute a robust segment, contributing nearly 15% to global foundry utilization by 2024.

- Telecom and IoT: The global rollout of 5G networks created a surge in demand for RF chips, while IoT-enabled smart devices added to the capacity requirements.

- Artificial Intelligence and HPC: High-performance computing (HPC) systems and generative AI applications have been pivotal, with GPUs and specialized AI accelerators fueling growth.

For instance, NVIDIA’s reliance on TSMC for its GPUs exemplifies how AI development drives foundry expansion.

2)Strategic Investments and Incentives:

The semiconductor industry’s investments in research and development have surged, with key players collectively spending over $60 billion annually on facility expansion and process innovation. Additionally, government policies like the U.S. CHIPS Act and similar initiatives in Europe and Asia have funneled billions into capacity-building to reduce dependence on specific regions.

Who is leading the semiconductor foundry business?

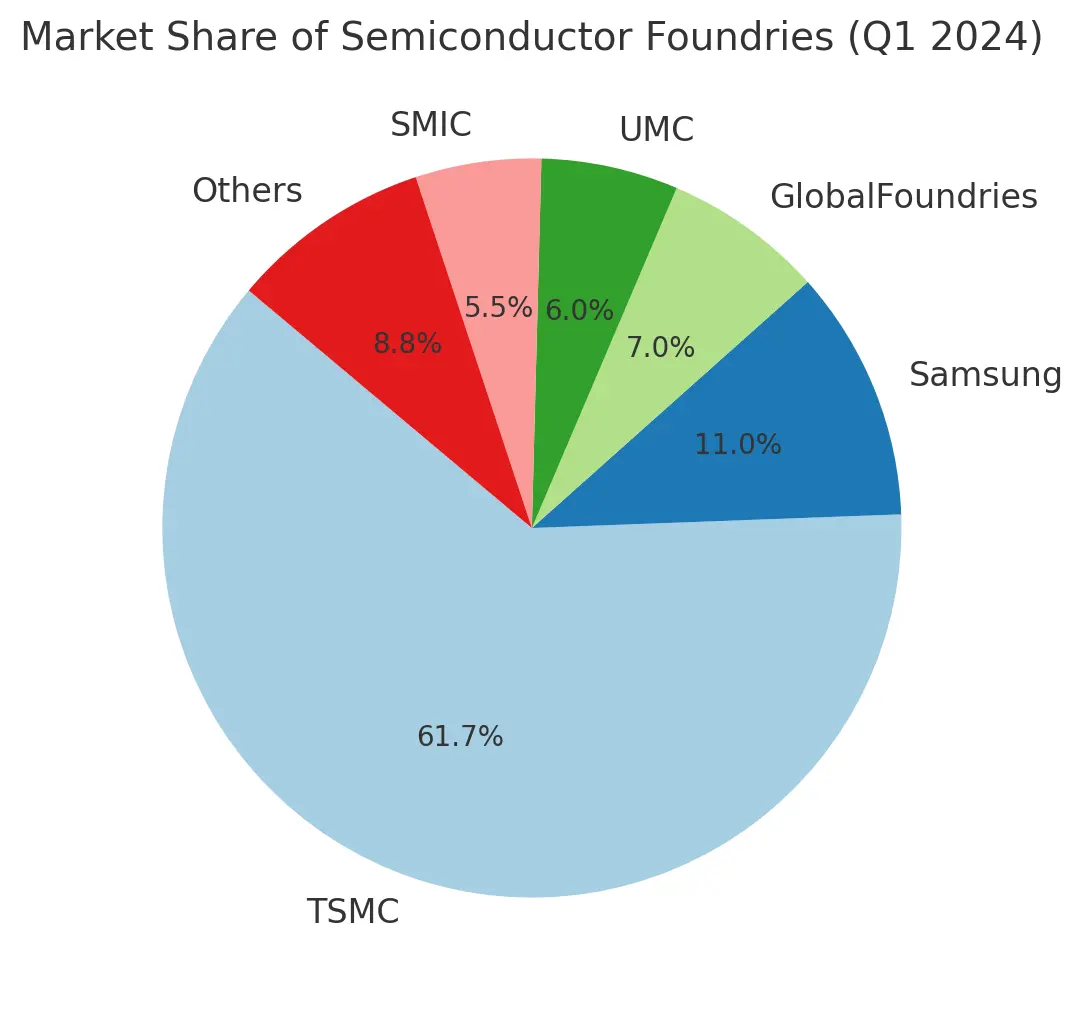

The semiconductor foundry market remains highly competitive, with Taiwan Semiconductor Manufacturing Company (TSMC) maintaining a dominant market share of 61.7% as of Q1 2024. Its leadership stems from cutting-edge process nodes like 3nm and 5nm, bolstered by long-term partnerships with tech giants such as Apple and NVIDIA.

Samsung, with a market share of 11%, is dwindling a bit due to its low yield issues but still is aggressively investing in advanced nodes and memory technologies to expand its footprint in high-performance and AI markets.

GlobalFoundries, with a market share of 7%, in contrast, is focusing on niche markets such as IoT and RF chips, leveraging cost-effective solutions for industries with specialized requirements.

SMIC and UMC, while largely catering to mature nodes, are critical in fulfilling demand in regions like China and Southeast Asia. This diversity among foundry leaders highlights the importance of specialization and strategic focus in sustaining market relevance.

Regional Shifts in Foundry Capacity

The semiconductor industry is undergoing significant geographic diversification, driven by the need for supply chain resilience and reduced regional dependencies:

Trending :US sanctions hit China’s semiconductor industry: 22,000 companies shut down between 2019 and 2023

Taiwan’s Continued Dominance:

Taiwan remains the global hub for semiconductor manufacturing, contributing over 60% of worldwide capacity by 2024. TSMC and UMC lead this dominance with their advanced technologies and well-established infrastructure, supported by a highly skilled workforce and government policies encouraging innovation.South Korea and China Rising:

South Korea’s semiconductor industry, spearheaded by Samsung, continues to thrive with substantial investments in 3nm and 2nm nodes. Similarly, China, despite facing export restrictions, is steadily building its semiconductor ecosystem. SMIC and local players are driving this growth, with China contributing nearly 25% of global capacity by mid-2024.North America and Europe’s Re-emergence:

In North America, the CHIPS Act has fueled significant investments, with companies like Intel and GlobalFoundries expanding their facilities. Europe, though slower to adopt, is focusing on securing semiconductor supply chains for critical sectors like automotive, collaborating with leaders like TSMC to establish a local footprint.India’s Entry into Semiconductor Manufacturing:

India is making its first major foray into semiconductor manufacturing with plans to establish 28nm fabrication facilities. While not as advanced as Taiwan or South Korea’s nodes, this initiative marks a crucial beginning for the country’s semiconductor ambitions. Supported by the Indian Semiconductor Mission and partnerships with international players, this move will enable India to build a self-reliant chip industry, catering to domestic and export markets. Although still in its infancy, India’s entry signals a shift towards further regional diversification in the global semiconductor landscape.Diversification and Localization:

Global foundries are increasingly localizing operations to mitigate risks associated with geopolitical tensions. TSMC’s expansion into Arizona and Japan and Samsung’s investments in the U.S. exemplify this trend, ensuring a more resilient and distributed supply chain.

Conclusion

While the foundry industry’s growth is impressive, it faces challenges such as geopolitical tensions, resource constraints, and environmental concerns. Water scarcity, essential for chip manufacturing, is a critical issue in key regions like Taiwan and China. Additionally, the transition to advanced nodes increases technological and financial barriers for new entrants.

Conversely, opportunities in emerging technologies like quantum computing, renewable energy systems, and edge AI provide new avenues for growth. Foundries must adapt to meet these evolving demands while addressing sustainability concerns.

Discover more from WireUnwired

Subscribe to get the latest posts sent to your email.