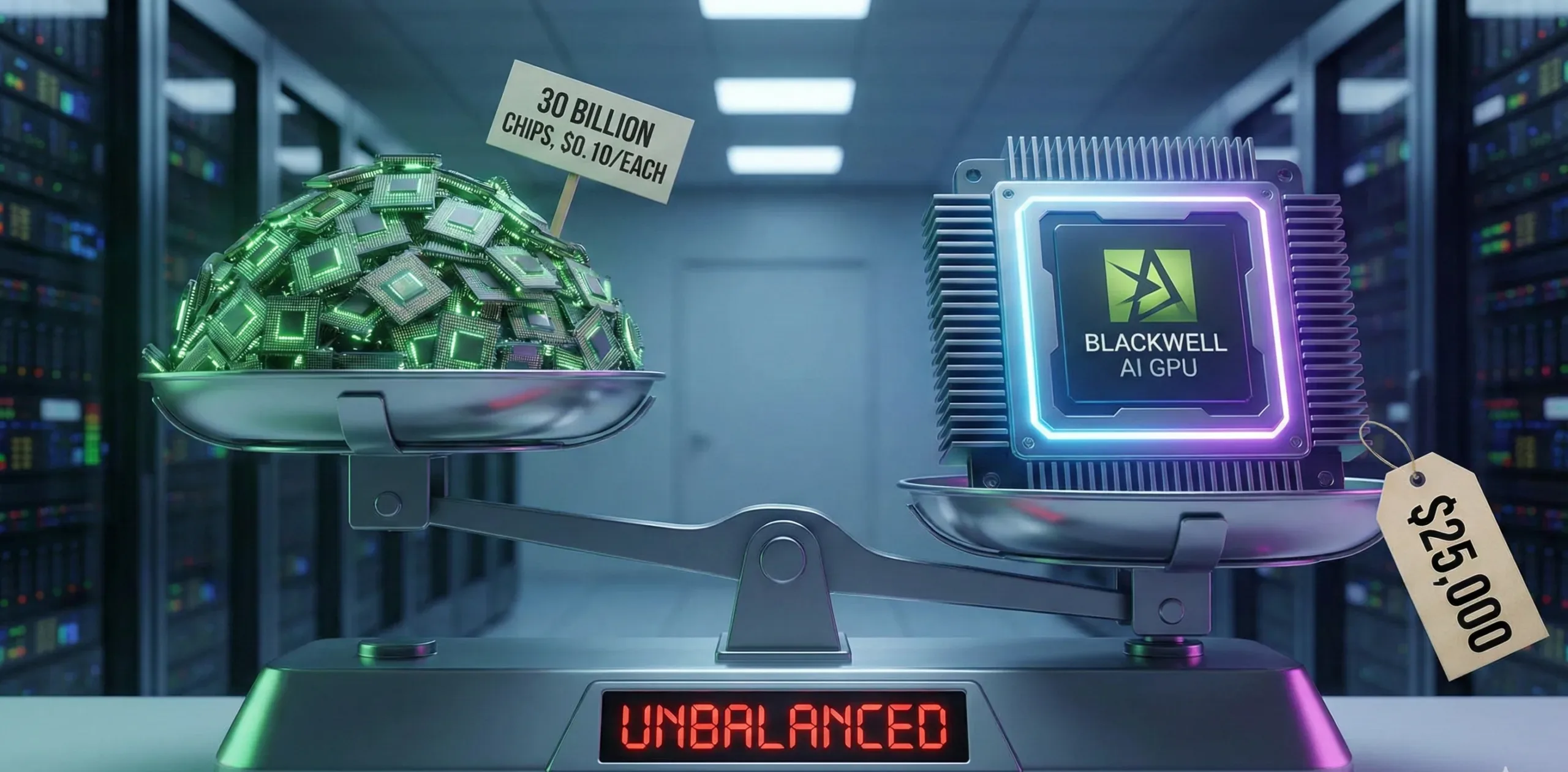

Arm collects roughly 1-2% in royalties on every chip built using its designs. On a $10 smartphone processor, that’s 10-20 cents. On a $50 automotive chip, maybe a dollar. On a $5,000 AI accelerator for data centers? Still just $50-100, while Nvidia captures the other $4,900+ by actually selling the silicon. This royalty model made Arm ubiquitous—over 300 billion chips shipped, 30 billion last year alone—but as AI reshapes the semiconductor industry around high-value, high-performance chips, that 1-2% looks increasingly inadequate.

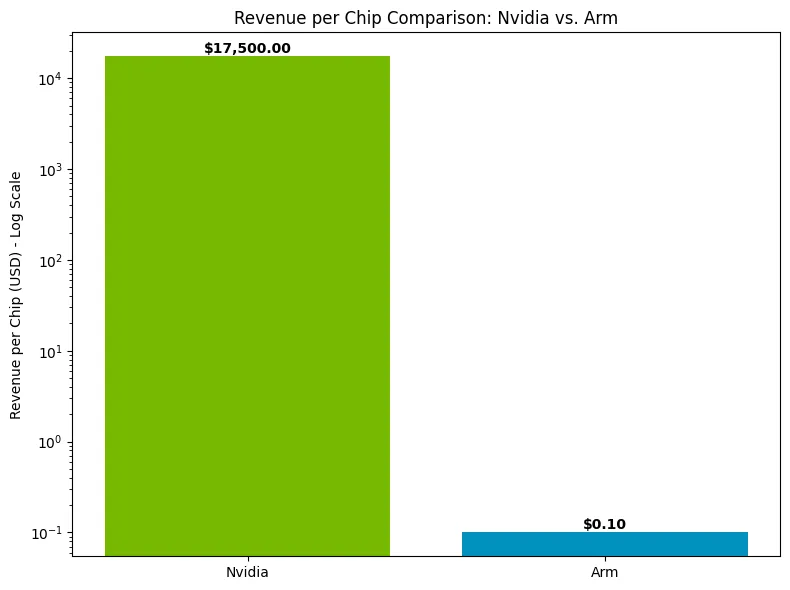

The numbers tell the story. Arm’s fiscal 2024 revenue hit approximately $3.2 billion. Sounds impressive until you realize that’s from 30 billion chip shipments—roughly 10 cents per chip on average. Compare that to Nvidia, which generated $60 billion in fiscal 2024 revenue selling perhaps 3-4 million AI GPUs. Nvidia’s revenue per chip: around $15,000-20,000. Arm’s revenue per chip: $0.10. The gap isn’t a rounding error—it’s a fundamentally different business model that AI economics are making unsustainable.

Here’s what Arm actually charges. License fees range from hundreds of thousands to tens of millions of dollars depending on design complexity and usage rights. A company licensing Arm’s Cortex-A series for smartphones might pay $1-5 million upfront. For high-performance Neoverse designs targeting data centers, licenses can reach $10-20 million or more. Then come royalties: typically 1-2% of the chip’s average selling price, though this can vary. High-volume customers like Apple, Qualcomm, and Samsung negotiate lower rates through architectural licenses that give more design freedom in exchange for upfront payments.

⚡

WireUnwired • Fast Take

- Arm charges 1-2% royalties per chip—$0.10 average across 30B annual shipments

- FY2024 revenue: $3.2B from licensing vs Nvidia’s $60B selling actual chips

- AI accelerators sell for $5K+ but Arm captures only $50-100 per chip in royalties

- Shift to higher royalties or direct sales risks pushing customers to RISC-V alternative

The AI shift changes everything because chip economics invert. Mobile processors shipping billions of units at $10-30 each made sense for Arm’s royalty model—low per-unit revenue but massive volume. AI chips flip this. Nvidia’s H100 GPUs sell for $25,000-40,000 each. Amazon’s Graviton3 processors for AWS cost hundreds of dollars. Google’s TPU v5 chips command premium pricing. Microsoft’s custom AI silicon for Azure follows similar economics. These are not volume plays—they’re high-value, specialized processors where the majority of economic value goes to whoever sells the silicon, not who licensed the underlying architecture.

Let’s quantify the opportunity Arm is missing. The AI chip market is projected to reach $100-150 billion by 2027-2028. If Arm-based designs capture even 20% of that market—conservative given Arm’s data center momentum—that’s $20-30 billion in chip sales annually. At Arm’s current 1-2% royalty rate, that’s $200-600 million in revenue. If Arm could capture 10-15% instead through different commercial structures, that’s $2-4.5 billion—potentially doubling the company’s entire revenue from AI chips alone.

The challenge is how to capture that without destroying the ecosystem. Arm’s neutrality enabled its dominance. Apple designs its own processors using Arm architecture. So does Qualcomm, Samsung, Amazon, Google, Microsoft, Nvidia (for some products), and dozens of others. They all license from Arm precisely because Arm doesn’t compete with them. This neutrality created a virtuous cycle: more licensees meant more software ecosystem development, which made Arm more attractive, which brought more licensees. Breaking that neutrality risks the entire flywheel.

SoftBank’s 2023 IPO added pressure. Public markets expect growth, and Arm’s licensing model has natural limits. There are only so many chip designers globally. License revenue grows when signing new customers or renewing existing ones at higher rates, but the customer base is finite. Royalty revenue scales with chip shipments, but per-chip rates face constant negotiation pressure as volumes increase. Arm reported 21% year-over-year royalty revenue growth in fiscal 2024, strong but not enough to justify the valuation multiples public markets assigned.

Recent moves signal Arm is testing new approaches. The company introduced Arm Total Design in 2023, offering more complete chip solutions rather than just licensable IP. This moves Arm closer to delivering full designs that customers can manufacture with less customization—capturing more value but also reducing the flexibility customers traditionally enjoyed. Arm has also pushed for higher royalties on its latest v9 architecture, reportedly seeking 2-3x increases over v8 rates for some use cases.

The nuclear option—Arm selling chips directly—would maximize revenue but alienate every current customer. Imagine Apple’s reaction if Arm started selling processors that compete with iPhone chips. Or Qualcomm’s response if Arm entered the smartphone SoC market directly. Or Amazon’s if Arm launched competing data center processors. Every licensee would immediately accelerate RISC-V adoption to reduce dependence on a supplier-turned-competitor.

RISC-V represents the existential threat Arm can’t ignore. As an open-source instruction set architecture, RISC-V requires no licensing fees and no per-chip royalties. Companies invest more upfront in design and ecosystem development, but avoid ongoing payments entirely. If Arm pushes royalties too high or creates competitive conflicts, RISC-V becomes economically attractive despite higher initial costs. Google, Qualcomm, and others already have RISC-V programs running in parallel to Arm development—insurance policies against Arm becoming too expensive or unreliable as a partner.

The middle path Arm seems to be exploring: value-based pricing that increases royalties for high-performance AI chips while keeping mobile rates stable, combined with offering more complete solutions that command higher upfront fees. This captures more AI value without fully abandoning the licensing model or competing directly. It’s incrementalism rather than revolution.

The risk is whether incremental changes capture enough value to satisfy public market growth expectations while avoiding customer defection to RISC-V. Arm’s fiscal 2024 operating margin ran around 25%—healthy but not extraordinary for a pure IP company. Nvidia’s operating margin exceeds 60%. That gap reflects the difference between licensing designs and selling chips. Arm wants to narrow that gap without becoming Nvidia—which may not be possible.

Industry dynamics add complexity. TSMC, Samsung, and Intel all manufacture Arm-based chips for various customers, creating dependencies that limit Arm’s strategic flexibility. If Arm pushed too aggressively on royalties or started competing directly, foundries might favor RISC-V to maintain customer relationships. The semiconductor ecosystem is tightly interconnected—Arm can’t optimize its business model in isolation without considering how partners and customers respond.

The fundamental tension: Arm’s value comes from being the neutral platform everyone builds on. Capturing more of the value created on that platform requires becoming less neutral. AI makes this trade-off urgent because the stakes are now measured in tens of billions annually rather than billions. Arm must decide how much neutrality it can sacrifice before losing the platform advantage that made it valuable in the first place.

For now, Arm dominates mobile, grows in data centers, expands in automotive, and maintains momentum in edge computing. The licensing model still works—$3.2 billion in annual revenue with 25% margins proves that. The question isn’t whether the model works today. It’s whether it can capture enough of AI’s value tomorrow to justify Arm’s $54 billion market capitalization and meet public market growth expectations without breaking the ecosystem dynamics that created that value in the first place.

For discussions on semiconductor business models, chip architecture economics, and industry strategy, join our WhatsApp community where industry analysts break down competitive dynamics.

Discover more from WireUnwired Research

Subscribe to get the latest posts sent to your email.