⚡

WireUnwired Research • Key Insights

- SpaceX is preparing a dedicated Falcon 9 mission to deploy 36 SDA( Tranche 2 Tracking Layer satellites, one of the largest single-wave upgrades ever to the U.S. missile-warning and tracking architecture in medium Earth orbit (MEO).

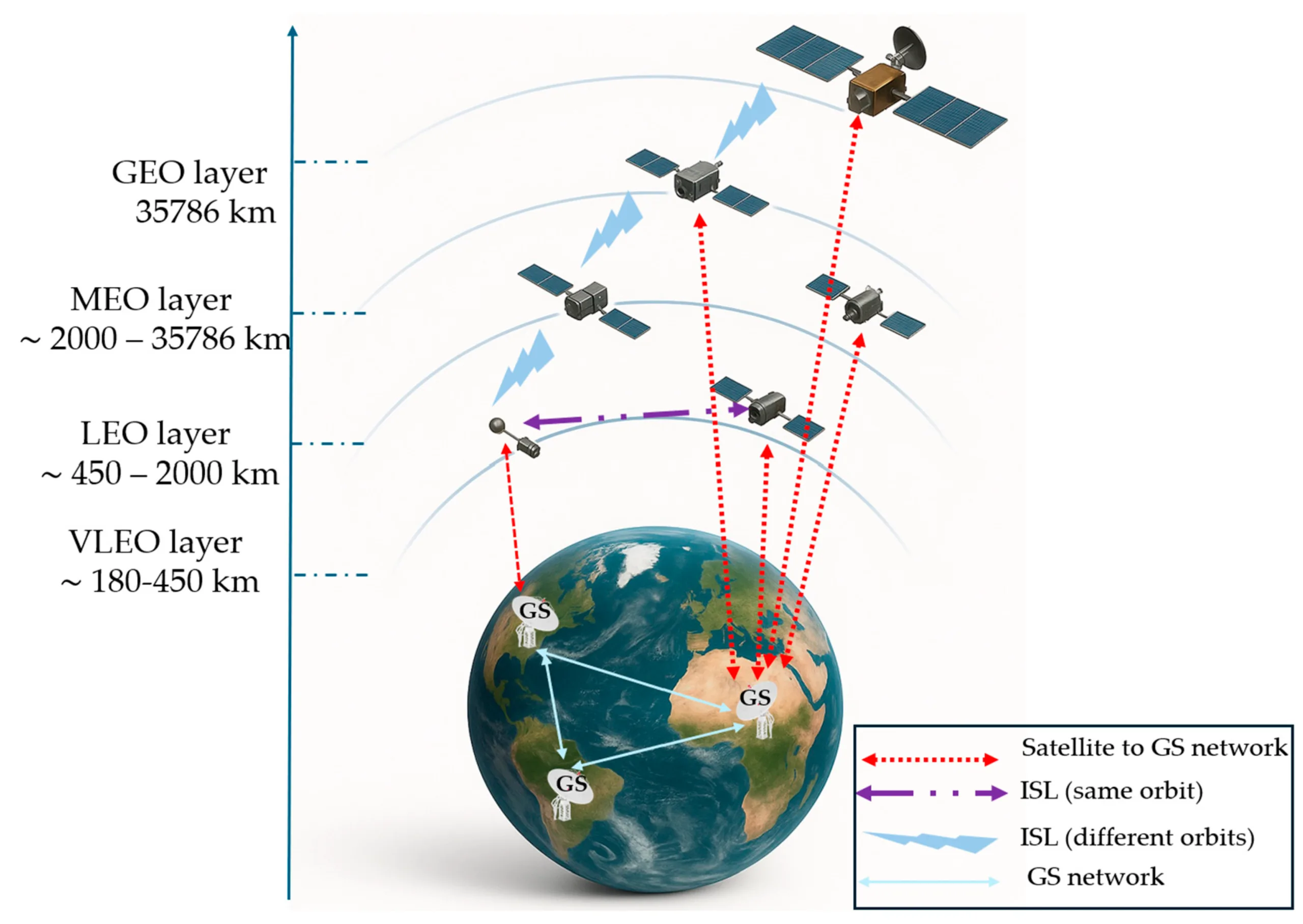

- The launch accelerates the Space Development Agency’s(SDA) shift from a few exquisite GEO platforms(Geostationary Earth Orbit) to a proliferated LEO(Lower Earth Orbit)+MEO hybrid constellation using small, networked infrared satellites for global hypersonic and ballistic threat tracking.

- By harnessing commercial launch cadence and rideshare-style integration, the Pentagon is effectively weaponizing commercial space logistics into a responsive, upgradeable national-security sensor grid.

- This build-out is a structural, hardware-heavy move that could reshape allied early-warning networks, tighten U.S.-partner command-and-control, and raise the capital spending bar for rival powers.

SpaceX is about to light up a quiet but strategically explosive corner of the space race: a dedicated Falcon 9 launch carrying 36 Tranche 2 Tracking Layer (T2TL) satellites for the U.S. Space Development Agency. This is not another Starlink batch or a headline-grabbing crewed mission — it is a mass upload of missile-tracking hardware into medium Earth orbit that turns the sky itself into a live sensor web for hypersonic and ballistic threats. For investors and operators in launch, sensors, defense primes, and dual-use space tech, this mission is a signal: the Pentagon’s next wave of spending is flowing toward proliferated, upgradeable constellations in commercially serviced orbits. The center of gravity in missile warning is

Shifting from a handful of exquisite GEO sentinels to an always-on, software-defined mesh — and SpaceX is becoming its default logistics backbone.

Why This 36-Satellite Wave Matters Now: Geopolitics, Budgets, and the Hypersonic Gap

The timing of this 36-satellite Tranche 2 Tracking Layer launch is not accidental; it is the hardware answer to a tightening geopolitical vise. Over the past five years, China, Russia, and several regional powers have poured resources into maneuverable hypersonic glide vehicles and advanced ballistic systems explicitly designed to exploit gaps in legacy U.S. early-warning architectures anchored in geostationary orbit.

Traditional GEO missile-warning platforms are powerful but few, slow to refresh, and expensive to replace. They were optimized for predictable ballistic arcs, not low-altitude, high-maneuverability profiles that disappear against complex backgrounds. The SDA’s MEO tracking layer directly targets that vulnerability.

At the same time, U.S. defense planning has pivoted from counterinsurgency to pacing threats in the Indo-Pacific and Europe, where minutes — or seconds — of additional warning time can recalibrate the entire kill chain from space through command centers to interceptors.

A proliferated MEO layer offers broad regional coverage with fewer satellites than LEO, better latency and resiliency than GEO(Geostationary Earth Orbit)-only designs, and more flexibility to re-task sensors via software. It complements the SDA’s low Earth orbit layers, adding depth and persistence in bands that are harder to saturate or blind.

Budget-wise, the Pentagon is in the middle of a reallocation cycle: more dollars are moving from legacy big-iron space programs into scalable, commercially serviced constellations that can be upgraded every few years instead of every few decades.

A 36-spacecraft deployment on a commercial launcher shows that the U.S. is willing to buy capacity and cadence rather than just bespoke one-offs. This crowding-in of commercial launch and bus vendors also sends a deterrent message: U.S. missile-warning infrastructure is becoming harder to pre-target, easier to reconstitute, and more deeply integrated with allies’ systems.

For China and Russia, staying competitive now requires not just missiles but parallel investments in space sensing, networking, and counter-space capabilities — a costly, multi-domain escalation that favors economies with deep innovation ecosystems.

How the New Tracking Layer Works: From Infrared Pixels to Interceptor Cues

The Tranche 2 Tracking Layer is designed as a proliferated infrared sensor mesh in MEO, tightly integrated with SDA’s( Space Development Agency) low Earth orbit transport and tracking tiers. Each of the 36 satellites headed up on Falcon 9 is a small, largely standardized spacecraft carrying advanced infrared payloads optimized to detect the faint, fast-changing signatures of hypersonic and ballistic threats against complex Earth backgrounds.

Unlike traditional GEO early-warning satellites that stare from a single vantage point, these MEO sensors operate in coordinated orbits, providing overlapping fields of view over key theaters.

Operationally, the flow starts at the sensor: wide-field and/or multi-band infrared detectors continuously scan for heat plumes and kinetic signatures associated with missile launches, mid-course maneuvers, and terminal phases. Onboard processing filters out clutter — from weather patterns to civilian thermal activity — and flags potential threat tracks.

Instead of downlinking raw data to a small set of ground stations, each satellite uses crosslinks to pass refined tracks across the constellation and into SDA’s LEO transport layer. That optical or RF mesh enables low-latency routing of targeting-quality data directly into military command-and-control networks, bypassing many of the bottlenecks of legacy ground-centric architectures.

Because the constellation is proliferated, no single satellite is a crown jewel. That changes the economics of resilience: satellites can be built on more commercialized buses, integrated in near-assembly-line fashion, and regularly updated with improved sensors or processing hardware. A 36-bird deployment on a single Falcon 9 is a visible embodiment of this doctrine — treat space nodes as replaceable, software-defined assets rather than irreplaceable monuments.

SpaceX’s high launch cadence and rideshare-style integration flows are central here: payloads can be manifested late, standardized interfaces simplify stacking, and missions can be scheduled to meet defense timelines rather than the other way around.

The medium Earth orbit choice is strategic. MEO sits above LEO’s atmospheric drag but below GEO’s extreme distances, providing a sweet spot where dozens — not hundreds — of satellites can maintain global or regional coverage with reasonable latency. For missile warning and tracking, this means fewer satellites are needed to maintain persistent custody over long trajectories, and re-entry or glide-phase maneuvers can be followed longer from multiple angles.

As SDA fuses MEO tracking data with LEO sensor inputs and ground-based radars, the result is a multi-layered custody chain that feeds both homeland defense and theater-level systems. Over time, software upgrades can improve detection algorithms, integrate AI-based discrimination of decoys, and adapt to new threat signatures without waiting for a new generation of giant GEO platforms.

Inside the Shift: GEO Legacy vs SDA’s Proliferated LEO+MEO Architecture

| Dimension | Traditional GEO Missile Warning | SDA Proliferated LEO+MEO (incl. 36 T2TL) |

|---|---|---|

| Orbit Regime | High-altitude GEO (~36,000 km), few satellites covering large areas | Hybrid LEO + MEO, dozens to hundreds of small satellites with overlapping coverage |

| Constellation Size | Single digits to low teens of large, exquisite platforms | Proliferated architecture; this mission alone adds 36 MEO tracking satellites |

| Primary Mission | Strategic ballistic missile launch detection and initial warning | Global hypersonic and ballistic tracking in near-real time, including maneuvering threats |

| Resilience | High-value, high-payoff targets; difficult and slow to reconstitute | Many smaller nodes; damage or jamming is diluted, and assets are easier to replace via commercial launch |

| Upgrade Cycle | Decades-long; major technology upgrades tied to new flagship satellites | Years-scale; new tranches like T2TL can introduce upgraded sensors and processors regularly |

| Industrial Base | Concentrated among a few traditional primes | Mix of primes and commercial space players (launch, buses, payloads, software) |

| Launch Model | Infrequent, bespoke missions with long integration timelines | Higher-frequency, commercial launch with rideshare-style integration; this Falcon 9 deploys 36 payloads at once |

| Cost Profile | Few platforms with very high unit cost | Larger number of smaller satellites; higher aggregate spend but lower unit cost and better marginal capability per dollar |

Where the Money Flows Next: Defense, Dual-Use Space, and Competitive Pressure

The deployment of 36 Tranche 2 Tracking Layer satellites via a single Falcon 9 is both a procurement signal and a market catalyst. For U.S. and allied defense budgets, it validates a multi-year capex trajectory centered on proliferated constellations, advanced infrared payloads, and mesh networking — all of which are inherently upgrade- and launch-hungry.

Instead of occasional, multi-billion-dollar GEO programs, planners increasingly face recurring tranche buys: dozens of satellites, multiple orbits, and regular refresh cycles. This pattern tends to lock in higher baseline spending on space-based sensing, software, and launch services, even under budget pressure.

For commercial players, the most direct upside sits with launch providers, satellite bus manufacturers, infrared and sensor specialists, optical inter-satellite link vendors, and the emerging class of space-domain-awareness and mission-assurance firms that help protect and manage dense constellations.

Every hardware tranche like this one creates follow-on demand in ground systems, secure networking, data fusion software, and AI-enabled analytics that can turn raw tracks into actionable cues. Dual-use startups able to sell both to SDA-style programs and commercial Earth-observation or communications markets stand to benefit from shared manufacturing lines and common software stacks.

Internationally, this MEO tracking expansion raises the bar for rival systems. China and Russia will need to commit substantial capital to achieve comparable multi-layered custody over hypersonic and ballistic threats, likely diverting resources into their own proliferated constellations, counter-space tools, and hardened command-and-control.

That dynamic can drive regional space-defense spending up, particularly in NATO allies and Indo-Pacific partners that will seek tighter integration with U.S. warning networks to avoid technological dependency gaps. Over the medium term, investors should expect more joint programs, co-funded payloads, and possibly shared launch campaigns that blend military and commercial assets.

The broader commercial-space market will not move in lockstep with any single launch, but this mission is a clear marker that national security is anchoring demand for high-cadence, high-capacity launch and for modular spacecraft platforms. That anchor demand can improve factory utilization, stabilize cash flows for key industrial players, and de-risk capital-intensive infrastructure like new launch pads, manufacturing lines, and in-orbit servicing capabilities.

As SDA and its counterparts continue to buy in tranches, the winners will be firms that can meet defense timelines without sacrificing commercial cadence — effectively operating at the intersection of Silicon Valley iteration speed and Pentagon-grade reliability.

FAQ

What exactly is the SDA Tranche 2 Tracking Layer?

It is a set of next-generation missile-warning and missile-tracking satellites designed to operate primarily in medium Earth orbit, forming part of the U.S. Space Development Agency’s proliferated architecture. The 36 satellites on this upcoming Falcon 9 launch are a major expansion of that layer.

How is this different from Starlink launches?

Starlink missions deploy commercial broadband internet satellites in low Earth orbit for civilian and enterprise connectivity. This dedicated Falcon 9 flight is focused on national-security payloads: specialized infrared tracking spacecraft for missile detection and tracking, distinct from SpaceX’s commercial communications business.

Why use medium Earth orbit instead of just GEO or LEO?

MEO offers a balance of coverage and latency. Fewer satellites than LEO are needed for broad regional or global coverage, while distances are shorter than GEO, improving responsiveness and enabling better tracking of long, maneuvering trajectories when combined with other layers.

Does this constellation only track hypersonic missiles?

No. While a key driver is the need to track maneuverable hypersonic glide vehicles, the sensors are also designed to detect and track a wide range of ballistic threats, from traditional intercontinental ballistic missiles to more regional systems, across multiple phases of flight.

What role does SpaceX play beyond this single launch?

SpaceX provides the high-cadence, relatively low-cost launch infrastructure that enables the SDA to deploy large batches of satellites at once and refresh constellations frequently. Its integration and rideshare-style capabilities support the broader shift toward proliferated, upgradeable national-security space architectures.

Join our WireUnwired Research community on WhatsApp or LinkedIn.

Discover more from WireUnwired Research

Subscribe to get the latest posts sent to your email.