“Can Malaysia climb up the semiconductor value chain without enough engineers to build it?”

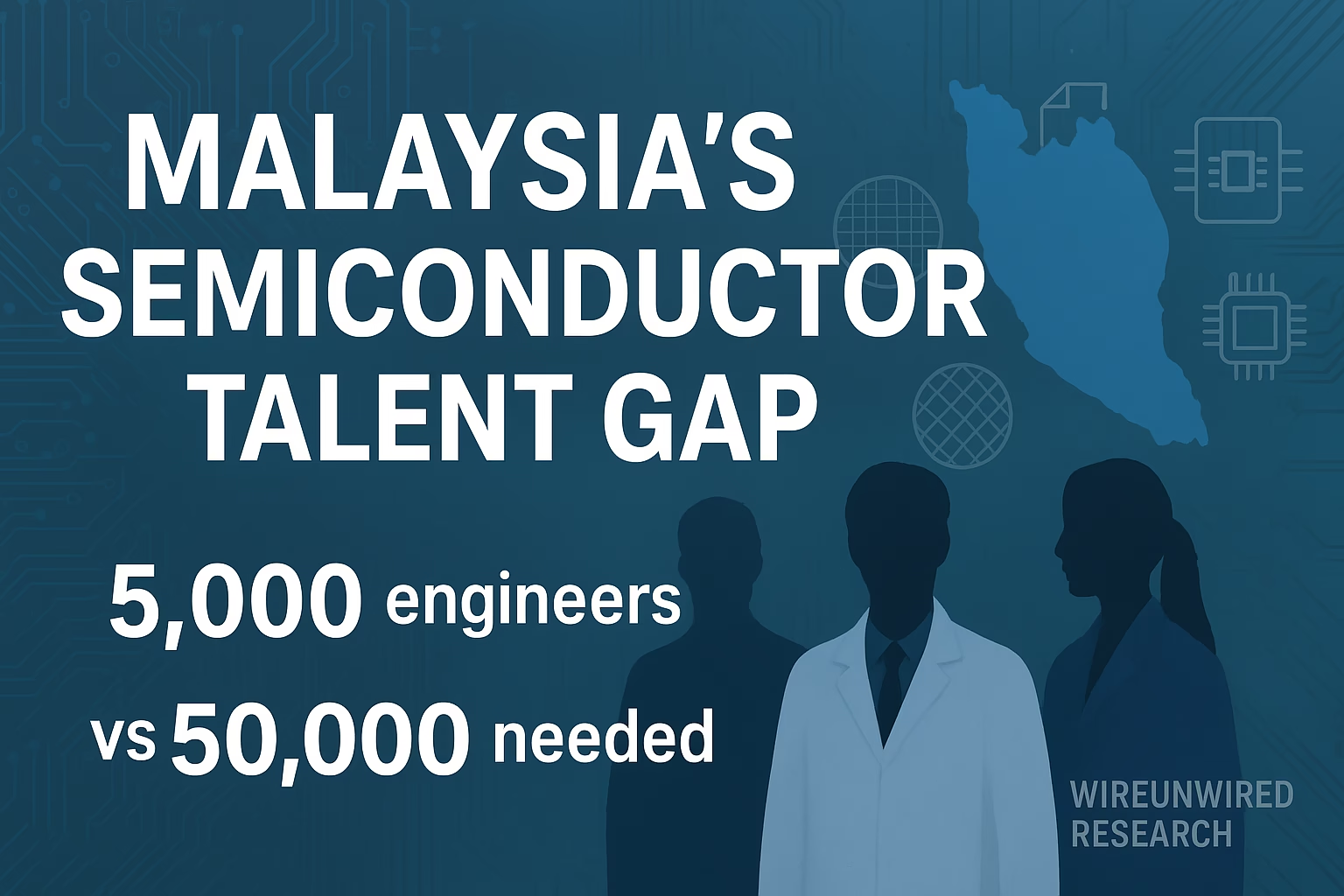

The semiconductor industry is shifting toward high-value areas like chip design, wafer fabrication, and advanced packaging. Malaysia, long known for assembly and testing, is struggling to keep pace, highlighting a significant Malaysia semiconductor talent gap. The country produces just 5,000 engineers a year against a demand for 50,000, leaving a critical shortfall at the heart of its semiconductor ambitions. That status quo is being challenged in 2025, as the government and industry are launching new strategies to expand the talent pipeline and move Malaysia higher up the semiconductor value chain.

Malasyia’s Semiconductor Talent Crunch

Malaysia’s semiconductor ambition is colliding with a simple arithmetic problem: supply versus demand. The country is needing around 50,000 skilled engineers, yet universities are producing barely 5,000 graduates annually. Even among these, many are not entering semiconductor roles, and those who do often are lacking the specialized skills required for front-end processes like IC design, wafer fabrication, and advanced chip packaging.

The National Semiconductor Strategy (NSS) is setting an ambitious target—train 60,000 high-skilled engineers by 2030 and foster at least 100 semiconductor-related firms. On paper, the numbers are looking achievable. In practice, the mismatch between education and industry, combined with ongoing brain drain, is leaving the pipeline stretched thin.

TRENDING

Causes and Challenges Behind Malaysia semiconductor talent gap

The Malaysia semiconductor talent gap is growing due to overlapping structural and workforce issues:

1) Mismatch between education and industry

- University curricula and TVET programs are staying outdated, often detached from fast-changing semiconductor technologies.

- Graduates are entering the job market without the practical skills needed for IC design, wafer fabrication, or advanced packaging.

2) Brain drain to higher-paying markets

- Malaysia is losing a large share of its skilled engineers to Singapore.

- Nearly half of Malaysians abroad are working in high-skill positions, with many showing little intent to return.

3) Weak R&D and infrastructure limits

- Limited access to advanced design tools and semiconductor labs is preventing local engineers from innovating at global standards.

- This lack of infrastructure is restricting Malaysia’s ability to build its own IP and move up the value chain.

4) SME dependence on low-skill labor

- Many SMEs are relying heavily on foreign workers.

- This is delaying automation and slowing down the demand for advanced engineering roles, reinforcing the skill shortage.

In short, Malaysia is facing a pipeline problem, a retention problem, and a structural problem—all at once.

How Malaysia is Handling this Talent Shortage…?

Malaysia is addressing its semiconductor talent gap through a combination of government strategies, industry collaborations, and upskilling programs:

1. Government Strategies

- National Semiconductor Strategy (NSS): Allocates RM25 billion (~USD $5.7B) over the next decade for capital grants, workforce training, industrial parks, and advanced fabs.

- 2025 Budget allocation: MYR1 billion (~USD $228M) is being invested in talent development, focusing on universities and IC design projects.

- Penang STEM Talent Blueprint (2024): Penang state is launching a pipeline program starting from primary school, emphasizing government-industry-academia collaboration under the THRIVE principles—Transform, Hire, Retain, Invest, Value, Enable.

2. Industry-Led Collaborations

- CREST (Collaborative Research in Engineering, Science, and Technology): Is supporting startups, incubators, and university partnerships to align research with industry needs.

- University-industry partnerships: Firms are providing hands-on training with the latest technologies and software, keeping both graduates and professionals ready for semiconductor roles.

3. Upskilling and Vocational Focus

- TVET reforms: Curricula are being modernized to match practical semiconductor skill requirements.

- Encouraging female participation: Efforts are promoting greater inclusion of women in STEM, aiming to double overall STEM enrollment.

4. Talent Retention and Reverse Brain Drain

- Competitive incentives: Government and companies are exploring higher wages, career progression pathways, and professional growth opportunities.

- Targeted SME support: Programs are upgrading SME workforce skills, encouraging automation and adoption of precision manufacturing tools.

Progress and Ongoing Obstacles

Malaysia is making visible progress, but several challenges are continuing to slow the pace:

Education lag

- Curricula are still trailing behind evolving semiconductor technologies.

- Graduates are leaving schools without the hands-on skills required by modern chip design and manufacturing roles.

Persistent brain drain

- High-paying opportunities abroad are attracting skilled engineers.

- Domestic talent retention is remaining a challenge despite incentives.

SME reluctance to modernize

- Many SMEs are relying on unskilled labor and are delaying automation.

- This is limiting the spread of advanced technical skills across the sector.

Infrastructure and R&D gaps

- Limited access to state-of-the-art labs and design tools is restricting innovation.

- Malaysia is still struggling to foster an R&D culture comparable to global semiconductor hubs.

Outlook

If current efforts are continuing at the present pace, Malaysia is gradually moving toward its target of training 60,000 high-skilled engineers by 2030. Government strategies, industry-led programs, and TVET reforms are creating a more robust talent pipeline.

Global supply chain shifts, such as the China+1 strategy, are increasing the urgency for Malaysia to secure skilled engineers. International investments are flowing into the country, presenting both opportunity and pressure to upskill local talent rapidly.

Three factors are determining the outcome:

Curriculum modernization: Universities and vocational programs must continue aligning with the latest semiconductor technologies.

Talent retention: Competitive wages, career pathways, and growth opportunities are needed to prevent brain drain.

SME adoption of advanced tools: Automation and precision manufacturing are required to elevate skills across the sector.

My view: Malaysia is on the cusp of transforming its semiconductor workforce. If reforms accelerate and collaboration deepens, the country could become a global player not just in assembly and testing, but also in high-value chip design and advanced manufacturing. Closing the Malaysia semiconductor talent gap will determine whether these ambitions are realized or remain out of reach.

Discover more from WireUnwired Research

Subscribe to get the latest posts sent to your email.