The semiconductor industry is poised for remarkable growth in 2025, driven by cutting-edge technology advances and strategic shifts in manufacturing. A fact that may surprise many is that the global semiconductor market is expected to reach an all-time high nearing $700 billion this year, fueled by surging demand for AI chips and data center expansions. At the same time, geopolitical tensions and supply chain challenges are prompting companies to rethink where and how chips are made, creating new opportunities in reshoring and advanced semiconductor packaging.

Advanced Semiconductor Packaging and AI-Driven Innovation Power Growth

One of the most transformative trends shaping the semiconductor industry in 2025 is the rise of advanced packaging technologies. Techniques like 3D stacking, system-in-package, and fan-out wafer-level packaging are enabling chips to become more powerful and energy efficient without relying solely on the traditional transistor shrinkage. Industry leaders such as TSMC, Samsung, and Intel are at the forefront of deploying these solutions to meet the stringent requirements of AI computing, 5G, IoT, and autonomous vehicles. For example, collaborations on 3.5D face-to-face packaging are enhancing AI chip performance, addressing power consumption and heat dissipation challenges.

AI-driven semiconductors will comprise around 20% of the market in 2025, growing over 30% year-over-year, and are no longer confined to large cloud data centers. These advanced chips are increasingly embedded in enterprise edge devices, smartphones, and IoT applications, thus expanding semiconductor market volume significantly. The shift toward AI-enabled manufacturing and design further accelerates innovation, supporting the development of next-generation chips tailored for generative AI and machine learning workloads.

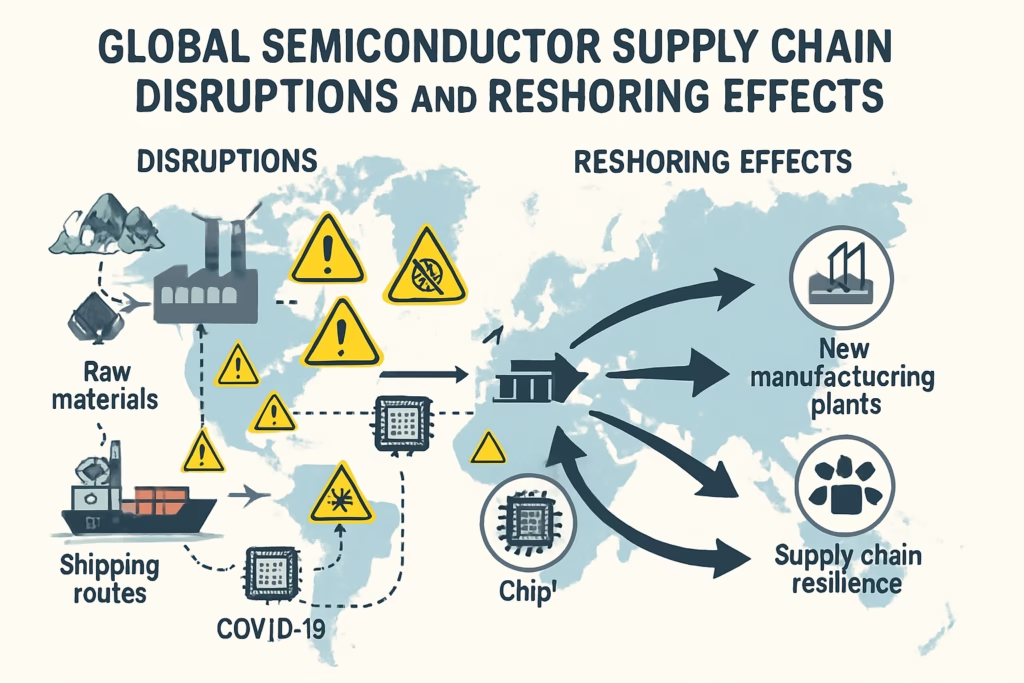

Geopolitical Dynamics and Supply Chain Disruptions Spur Reshoring of Semiconductor industries

Global political factors are dramatically impacting semiconductor supply chains and investment patterns. Export controls, particularly those imposed by the US on advanced semiconductor technologies and equipment, are reshaping where semiconductors are produced. As a result, many companies are adopting reshoring, nearshoring, and friendshoring strategies to reduce reliance on vulnerable foreign suppliers and mitigate trade tensions. This operational pivot, while increasing some costs, promises greater supply chain control and security.

India is emerging as a key beneficiary of these shifts, with substantial government incentives and investments under the India Semiconductor Mission. India has approved multiple projects in semiconductor fabrication, 3D packaging, and compound semiconductors, aiming to become a significant player in chip production by the end of 2025. This move aligns with a broader trend of countries seeking self-sufficiency and technological sovereignty in semiconductor manufacturing.

Market Outlook and Challenges Ahead

While the semiconductor industry anticipates robust capital expenditures exceeding $185 billion in 2025 to expand production capacity by 7%, several challenges remain. Supply chain disruptions continue due to complex regulations and export controls, making it critical for companies to navigate new trade policies effectively. Furthermore, workforce shortages and increasing research & development costs pose hurdles to sustained innovation and production scalability.

Nevertheless, semiconductor demand driven by AI compute, data centers, automotive chips, and advanced packaging solutions provides immense growth potential. Photonic and quantum integration technologies also promise to break bandwidth barriers and enable the next leap in semiconductor performance, with several developments expected to debut by 2026.

In essence, the semiconductor industry’s trajectory in 2025 is a compelling blend of technological breakthroughs, geopolitical realignment, and supply chain resilience. The interplay of these forces is shaping a market that not only grows rapidly but also innovates with agility and foresight.l

TRENDING

Discover more from WireUnwired Research

Subscribe to get the latest posts sent to your email.