Key Insights

- NAND flash memory is critical for digital storage but faces unique economic and strategic hurdles for US manufacturing.

- Despite large US investments in advanced chip and DRAM production, NAND fabrication remains dominated by a handful of non-US and global firms.

- Industry trends point to overcapacity, price pressures, and intense international competition shaping the future of NAND production.

A single smartphone can store tens of thousands of photos, while data centers power the internet’s memory—all thanks to NAND flash memory. Yet, despite the US government’s multibillion-dollar push to bring advanced semiconductor manufacturing home, there’s one glaring exception: the near-total absence of US-based NAND flash factories. Why is this crucial technology still largely produced abroad, and what does it mean for the future of American tech?

What Makes NAND Flash Memory Unique in the Semiconductor Landscape?

NAND flash memory is the backbone of modern digital storage, found in everything from smartphones and laptops to SSDs and cloud data centers. Its popularity comes from its ability to store large amounts of data at low cost, with rapid read/write speeds and no moving parts. NAND is distinct from DRAM (used for temporary memory in computers) and logic chips (used for processing tasks) in both technology and economics.

You would love to read :HBM VS DRAM : A Detailed Analysis

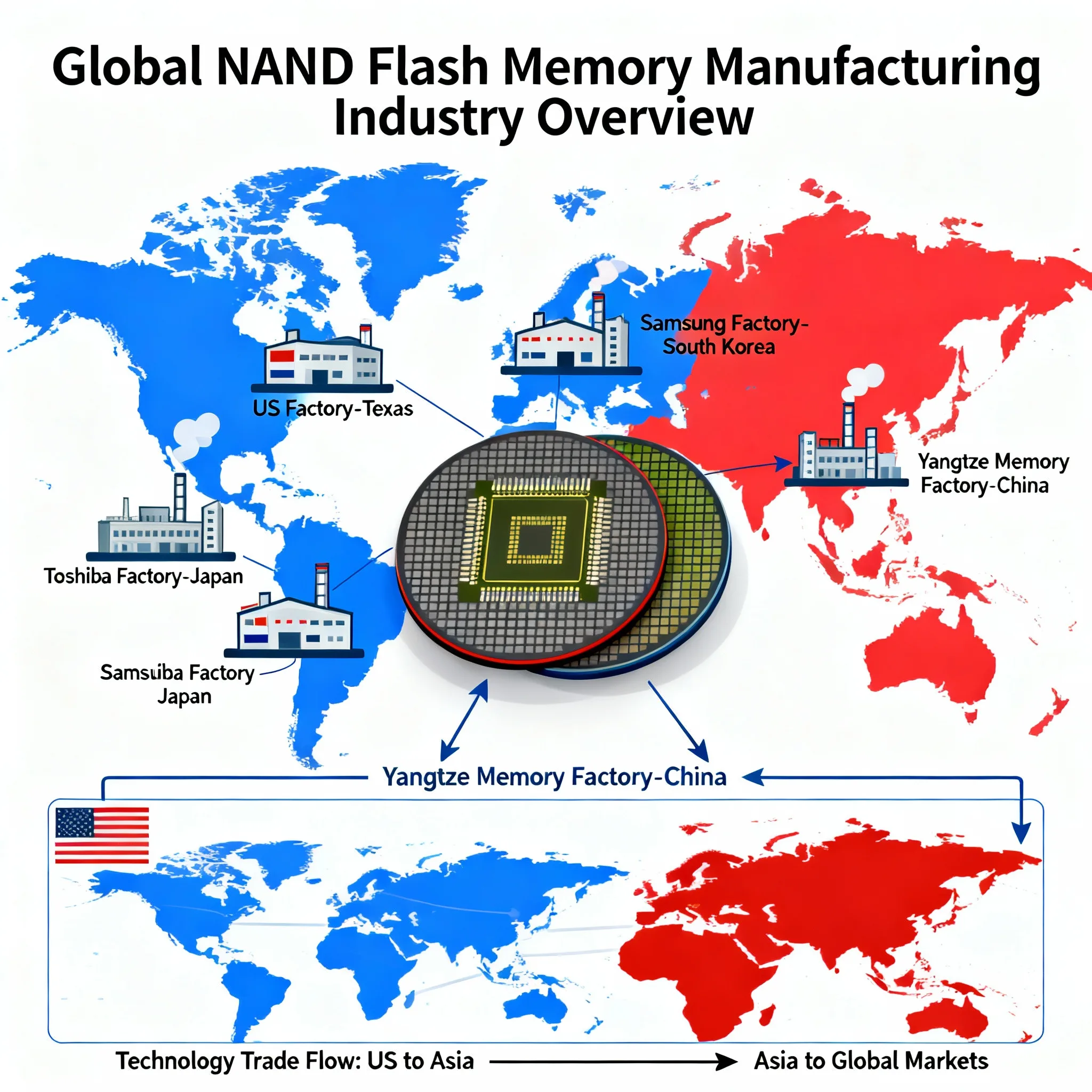

The global NAND flash market is tightly controlled by just five companies—Samsung, SK hynix/Solidigm, Kioxia/SanDisk, Micron, and Western Digital—which together account for over 90% of worldwide production. The technical complexity and massive investment required to build and operate a competitive NAND fab create high barriers to entry.

Even Micron Technology, the only US-headquartered NAND producer, has focused its most advanced fabrication outside the US and currently holds just an 11% global market share, with most of its expansion targeting DRAM in the US.

Why Isn’t NAND Flash Manufactured in the US?

While the US is investing heavily in bringing advanced chip and DRAM manufacturing stateside—such as TSMC’s 4nm and 2nm logic chip fabs in Arizona and Samsung’s new Texas facility—NAND production lags behind for several reasons:

- Low Profit Margins: NAND is a commoditized market with razor-thin margins, making it less attractive for high-cost US manufacturing compared to higher-value logic chips and DRAM.

- Global Overcapacity: The industry is struggling with oversupply and weak demand, forcing major players like Micron, Samsung, and Kioxia/SanDisk to cut production and delay technology upgrades . This discourages new investment in expensive US fabs.

- Not a Strategic Bottleneck: Unlike advanced processors or DRAM (critical for AI, defense, and high-performance computing), NAND is less often a chokepoint for national security or performance. Most NAND chips are used in consumer devices, and the US government’s strategic focus is elsewhere.

- Asian Manufacturing Ecosystem: East Asia—especially South Korea, Japan, and China—has decades of expertise, integrated supply chains, and government support, making it difficult for US fabs to compete on cost and scale .

Micron once produced legacy NAND in its Virginia fab but has shifted focus to DRAM and higher-margin products for its US investments. Meanwhile, Chinese firms are aggressively expanding domestic NAND production with state backing, further intensifying global competition and price pressure .

You would love to read :EU seems Worried Amid China’s Commodity Silicon Surge

Market Trends and the Future of NAND Flash Memory

Despite current headwinds, the NAND flash market is projected to reach $120 billion by 2035, driven by growing demand for smartphones, SSDs, and cloud infrastructure . Key trends shaping the future include:

- Innovation in 3D NAND and QLC Technology: New architectures are driving higher storage densities and lower costs per bit.

- Industry Consolidation: Ongoing production cuts and market pressures may force weaker players out, resulting in even greater concentration among top manufacturers.

- Geopolitical Dynamics: US policymakers may revisit incentives for domestic NAND production if supply chain security becomes a greater concern, but for now, the focus remains on logic and DRAM.

For US consumers and businesses, the lack of domestic NAND fabs has not impacted supply, thanks to global trade and robust inventories. However, the concentration of manufacturing in Asia makes the sector vulnerable to geopolitical shocks.

If national security or supply chain resilience ever demands it, industry analysts believe US companies could ramp up NAND production relatively quickly, given existing know-how and infrastructure. For now, the economics and global landscape keep most NAND flash manufacturing firmly overseas.

Discover more from WireUnwired Research

Subscribe to get the latest posts sent to your email.