Taiwan Semiconductor Manufacturing (TSMC), a big player in making computer chips, has its eyes on the trillion-dollar club by 2030. Although Nvidia briefly held the title of the first trillion-dollar chipmaker, TSMC, currently valued at $460 billion, suggests there’s room to grow. Let’s dig into why TSMC might be on the brink of something big.

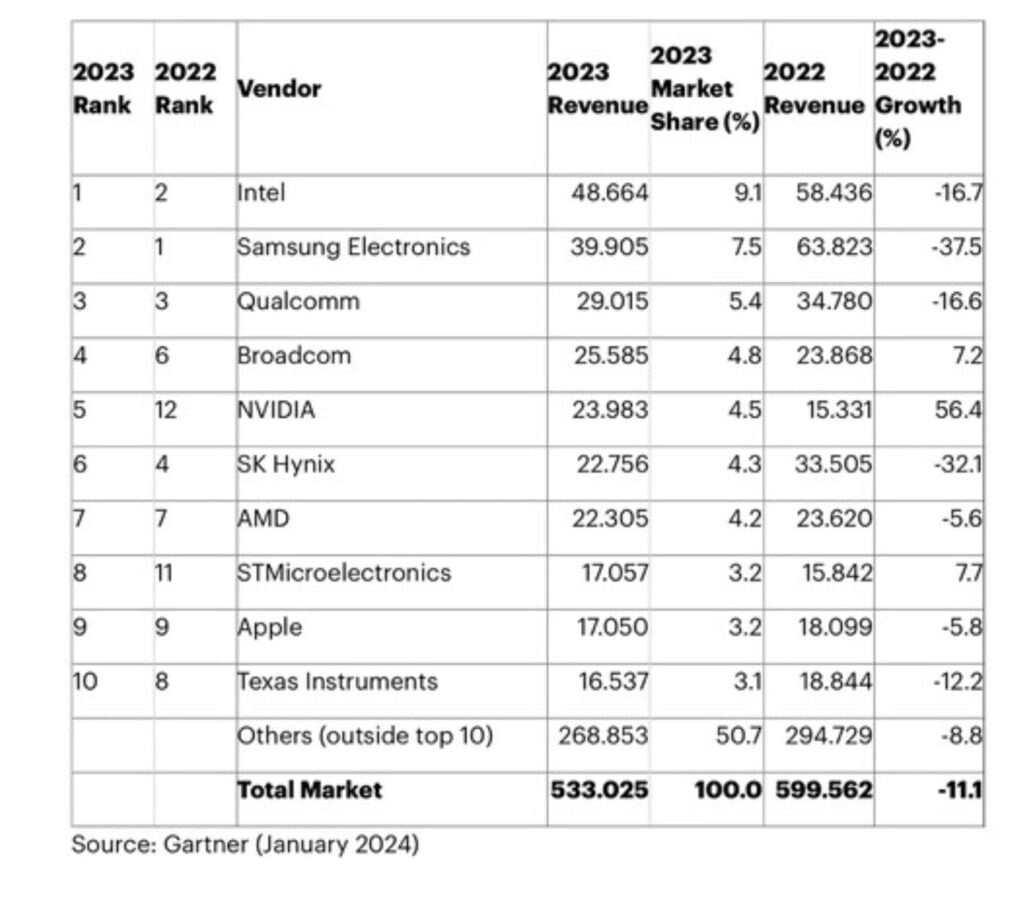

Introduction: TSMC, known for creating chips for big tech names like Apple and Nvidia, is crucial in the chip-making world. Even though Nvidia briefly hit the trillion-dollar mark, with a market share of 4.5 % and year and year growth of 56.4% TSMC’s current value of $460 billion indicates it could still grow.

Growth Outlook: TSMC’s money goes up and down with the chip industry. After a slow time in 2019 because fewer people were buying smartphones, things picked up in 2020 due to global uncertainties. Looking ahead to 2024, TSMC expects its money to grow because more people want advanced chips and those used in artificial intelligence.

Analysts predict TSMC will grow a lot from 2023 to 2025, with its money going up by 20% each year, and its earnings (profits) going up by 14%.

Challenges Ahead: While TSMC recently made its smallest 3nm chips and plans to make even smaller 2nm chips by 2025, there are challenges from rivals. Intel, a competitor, plans to launch even smaller 1.8nm chips this year. Recently TSMC announced that they are not going to install the ASML’s latest 18 A node EUV machine .BTW wehave covered a whole article on this move from TSMC , I would also recommend you to have a look at that article after u finish reading this .TSMC’s choice to stick to its current technology might save money but could be risky against Intel’s advances.

TSMC will probably only face two unpredictable challenges: Intel’s aggressive attempts to catch up in the process race, and a potential military or trade conflict between China and Taiwan, where TSMC still manufactures its most advanced chips. But even if Intel catches up, it could struggle to pull away TSMC’s longtime customers. If China actually tries to take over or blockade Taiwan, it would likely trigger a catastrophic market crash and crush most tech stocks along with TSMC.

Key Insight: TSMC believes it can keep using its current technology for 2nm chips until after 2030, saving costs but raising questions about how well it can compete with Intel.

Path to a Trillion-Dollar Value: If things stay steady, TSMC could reach a trillion-dollar value by making its profits grow by 10% each year from 2023 to 2030. Even though there might be challenges, like Intel trying to compete and issues between China and Taiwan, TSMC’s strong position and good relationships with customers could help it a lot.

Conclusion: To sum up, TSMC’s plans and potential growth could lead it to the trillion-dollar mark by 2030. Despite challenges, TSMC’s strong role in making chips makes it an interesting choice for investors looking for long-term growth. Keep an eye on TSMC, as it might continue to shine brighter than its rivals like Intel and Samsung in the chip-making world.

Investor Tip: For investors seeking lasting growth, TSMC is worth watching. Its resilience, smart planning, and potential to outshine competitors in the ever-changing chip landscape make it a good option for those looking for long-term investment opportunities.

Will TSMC be Trillion Dollar? A more analytical approach

Discover more from WireUnwired Research

Subscribe to get the latest posts sent to your email.