- Tesla’s semiconductor demand is surging due to AI, robotics, and autonomous driving ambitions.

- Elon Musk is exploring vertical integration with in-house chip fabrication to secure supply and reduce costs.

- Building a chip fab is a massive technical and financial challenge, but could reshape the auto and AI hardware landscape if successful.

Why Tesla’s Semiconductor Needs Are Exploding ?

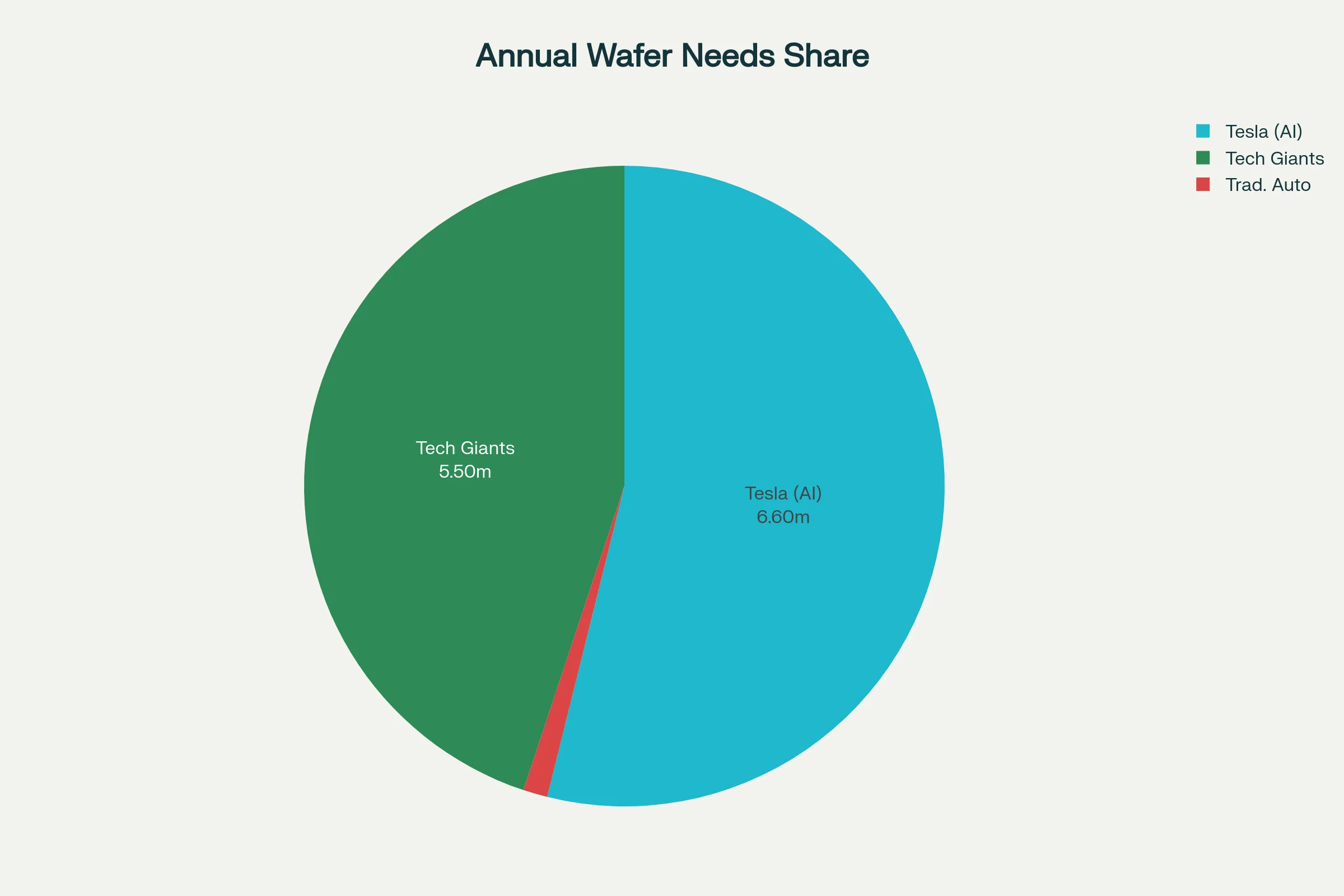

- AI compute for FSD and robotics: Tesla’s Dojo supercomputer and in-vehicle AI chips require significant silicon resources, especially as AI models grow in complexity.

- Supply chain bottlenecks: The global chip shortage during the COVID-19 pandemic exposed vulnerabilities in relying on external semiconductor suppliers, which previously forced production slowdowns across the auto industry.

- Geopolitical risks: With most advanced chip manufacturing concentrated in East Asia, Tesla faces potential disruptions from US-China tensions and limited access to the latest nodes.

Vertical Integration: Tesla’s Drive for Chip Independence

Unlike Apple or Nvidia, Tesla’s push for its own chip fab is rooted in a long-standing strategy of vertical integration—controlling as much of its supply chain as possible. This approach has already led Tesla to build its own battery, PCB, and recently, advanced semiconductor packaging plants in Texas .Key motivations include:- Securing chip supply: By manufacturing its own chips, Tesla can avoid future shortages and set its own production priorities.

- Cost reduction: In-house production could lower per-unit chip costs, especially at the massive volumes required for millions of vehicles and AI systems.

- Customization and performance: Owning the fab allows Tesla to rapidly iterate on custom chip designs, optimizing for AI workloads or vehicle integration without waiting for external partners.

The Technical and Economic Challenges Ahead for Tesla Terra Fab

Building a semiconductor fab is one of the most complex and capital-intensive industrial projects in existence. Industry experts, including Nvidia CEO Jensen Huang, have publicly warned that establishing a leading-edge fab from scratch is “extremely hard” and could take years or even decades to match the efficiency of giants like TSMC or Samsung .

Some core obstacles:

- Technological leap: Advanced nodes (under 10nm) require cutting-edge equipment, expert talent, and deep R&D pipelines.

- Upfront investment: State-of-the-art fabs cost $10–20 billion or more, with years before reaching full capacity.

- Talent and IP: Recruiting semiconductor veterans and building proprietary manufacturing know-how is a major challenge, though Musk has attracted talent from TSMC, Intel, and Samsung.

However, analysts note that Tesla may focus first on mature process nodes (14nm and above), which are still critical for automotive and industrial chips, before pushing into bleeding-edge territory. The company’s experience with large-scale manufacturing at SpaceX and Gigafactories could help accelerate timelines, especially if partnerships with Intel or others deepen .

Shaping the Future of AI and Automotive Hardware

If Tesla succeeds, it could become the first automaker with end-to-end control over vehicle and AI chip production—a move that would shake up both the semiconductor and automotive industries. While skeptics point to the immense risks and Musk’s penchant for audacious promises, the potential to de-risk supply chains and push the boundaries of AI hardware keeps the industry watching closely.

As the world’s cars, robots, and energy systems become ever more digital, the line between automaker and tech giant continues to blur. Tesla’s chip fab ambitions are the latest—and perhaps boldest—sign of this transformation.

Discover more from WireUnwired Research

Subscribe to get the latest posts sent to your email.