Key Insights

- India’s manufacturing PMI soared to 59.2 in October 2025, marking a five-year high driven by strong domestic demand and GST reforms.

- Growth outpaced exports, with local orders and productivity gains leading a surge in output and business optimism.

- Manufacturers remain upbeat about continued momentum, citing supportive policies and ongoing technology investments.

India’s manufacturing sector scaled new heights in October 2025, with the HSBC India Manufacturing Purchasing Managers’ Index (PMI) jumping to 59.2 from 57.7 in September. This marks the sector’s strongest performance in five years, underscoring the transformative role of recent GST 2.0 reforms, robust domestic demand, and productivity-enhancing technology investments. According to The Tribune India, this improvement reflects a quicker pace of expansion and a broad-based strengthening of manufacturing conditions.

Domestic Demand Fuels India’s Manufacturing Growth

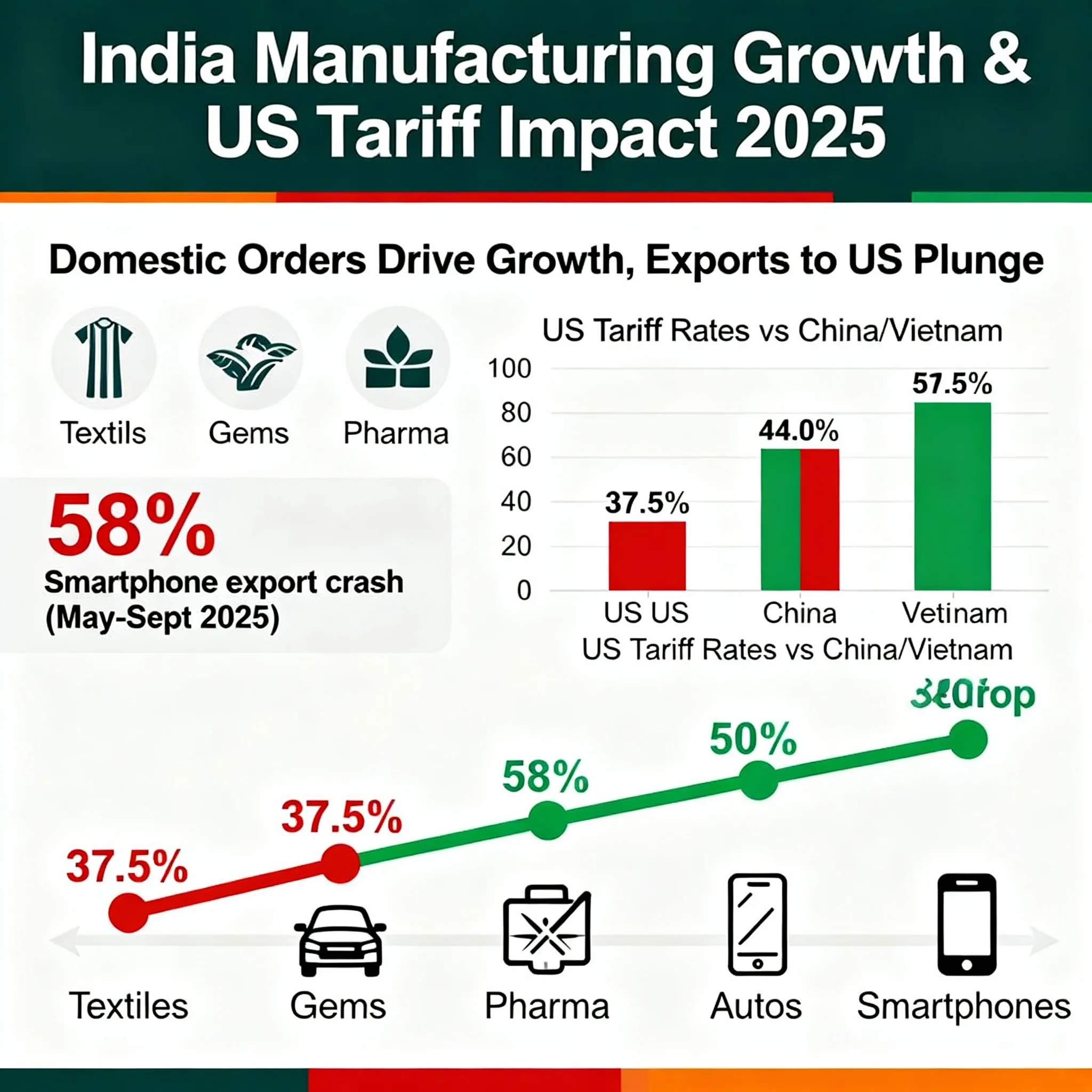

The October data highlights that the majority of India’s manufacturing growth continues to be fueled by the domestic market. New orders surged, boosting output and purchasing activity, with input inventories expanding at near-record levels. However, external sales rose at the slowest pace in ten months, reflecting the pronounced impact of US tariffs on Indian exports.

Since mid-2025, US tariffs on a broad range of Indian manufactured goods have escalated to as high as 50%, leading to a sharp 37.5% drop in exports to the US between May and September. Key sectors such as textiles, gems and jewelry, leather goods, marine products, chemicals, automobiles, smartphones, and pharmaceuticals have been the hardest hit.

For instance, According to a detailed analysis by the Global Trade Research Initiative (GTRI), smartphone exports crashed 58% from USD 2.29 billion in May to USD 884.6 million in September 2025. This decline occurred month after month—from USD 2.0 billion in June down to USD 884.6 million in September. These tariffs have not only reduced demand from the US but also made Indian products less competitive compared to countries like China and Vietnam, which face lower tariff rates. Job risks loom over labor-intensive export sectors as orders continue to contract.

Impact of GST Reforms and Technology Investments on Indian Manufacturing

Manufacturers credited the latest GST relief measures for lowering input cost pressures. As the GST Council had slashed the number of tax slabs from four (5%, 12%, 18%, 28%) to mainly two, with significant reductions across key categories:

Major reductions include:

- Manmade fibers and yarn: from 12-18% down to 5%

- Household appliances like air conditioners, washing machines, and televisions: from 28% to 18%

- Construction materials such as cement: from 28% to 18%

- Consumer goods like packaged foods and daily essentials: shifted to the 5% slab from higher rates

The lower GST, combined with increased technology adoption, helped enhance productivity. While input prices moderated due to these reforms, output prices continued to rise as businesses passed on some of the cost increases to consumers. The sector’s strong performance is also attributed to ongoing investments in automation and digital tools, which have enabled higher efficiency and competitiveness in the market.

Employment, Sentiment, and Future Outlook on India

Employment generation in the manufacturing sector continued for the twentieth consecutive month, reinforcing optimism about the sector’s resilience. Business sentiment remains high, with firms anticipating further gains from ongoing reforms and policy support. According to Trading Economics, companies expect continued improvements over the coming year, driven by GST rate cuts, new product launches, and targeted marketing efforts.

Public and Industry Response

Regional business media and economists have welcomed the PMI surge as a sign of India’s economic recovery and resilience, especially with the festive season underway. Manufacturers are optimistic about sustained demand and supportive government policies, though some remain cautious about rising output prices and the slower growth in exports. Social media commentary in India is largely positive, with many celebrating job creation and the effectiveness of the government’s recent economic reforms.

Join the Conversation

For deeper insights and discussion on India’s manufacturing sector and technology trends, join our WireUnwired Research WhatsApp group or connect with industry experts in our WireUnwired Research LinkedIn community.

Discover more from WireUnwired Research

Subscribe to get the latest posts sent to your email.