India’s drone market is growing fast, and the biggest push is coming from the drone defence sector. With rising border tensions and a need for real-time surveillance, India is no longer treating drones as a futuristic option — they’re becoming a battlefield necessity.

I’ve been closely tracking this shift. From loitering munitions and swarm drones to anti-drone jammers, the military drone space in India is quietly building an ecosystem that could define how modern wars are fought.

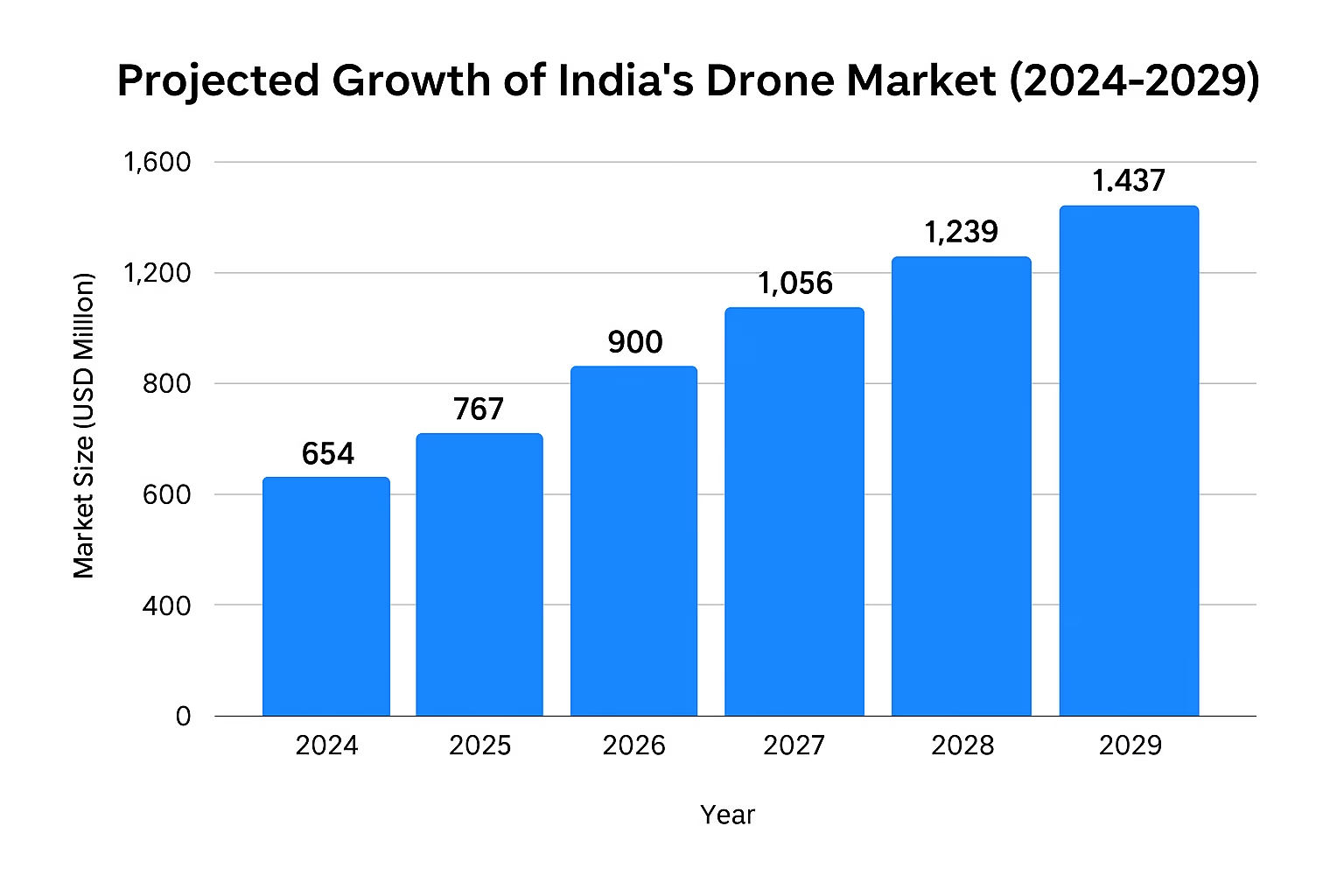

MarketsandMarkets projects India’s drone market will increase from USD 654 million in 2024 to USD 1,437 million by 2029, at a CAGR of ~17% (Reuters, MarketsandMarkets). That’s roughly ₹5,500 crore in 2024 scaling to ₹12,000 crore by 2029. Volume sales are expected to rise from ~10,800 units in 2024 to ~61,400 units by 2029 (MarketsandMarkets).

This is not just a new market — it’s a shift in how India wants to secure its borders and assert its presence in the region.

Government Support Is Strong, But the Ecosystem Isn’t Complete Yet

India isn’t just talking about drones. It’s backing them with policy. In 2021, the government banned drone imports, and the PLI scheme offered ₹120 crore to local manufacturers. But new data shows the incentive package is being expanded.

After drone use escalated in a border clash with Pakistan in May 2025, the Government approved a $234 million (₹2,000 crore) incentive programme over three years, aimed at boosting production of drones, components, counter‑drone systems, and services. The goal: domestically produce at least 40% of key drone components by FY 2028 (Reuters).

Despite that, the drone defence ecosystem still has weak links.

India is heavily dependent on imported subsystems:

- Flight controllers from China

- GNSS modules with limited encryption

- Motors and propulsion equipment with altitude limitations

This leaves the stack shaky and vulnerable.

The real opportunity lies in building secure avionics, AI‑driven autonomy, encrypted comms, and other defence-grade software systems.

Who’s Building India’s Drone Defence Stack?

| Startup / Company | Focus Area | Defence Use Case | Backing / Stage | Differentiator |

|---|---|---|---|---|

| ideaForge | Surveillance, Mapping | Army surveillance platforms | DRDO‑backed, IPO in 2023 | Mature drone platforms |

| NewSpace Research | Swarm drone platforms | Army & Air Force UAV swarms | DRDO/HAL partnerships | Battlefield swarming tech |

| Dhaksha Unmanned | Loitering munitions | Tactical missions | Coromandel subsidiary | Low-cost indigenous munitions |

| Garuda Aerospace | Dual‑use drones (Agri & Defence) | State-level security operations | DGCA‑approved, MoUs with states | Civil + military drone use cases |

| — Armory | Counter‑drone systems (C‑UAS) | Neutralizing rogue UAVs | ₹13 Cr seed round (2025), field-tested | AI‑based Samaritan OS for defence |

TRENDING

The Next Decade Won’t Be About Flying — It’ll Be About Winning the Silent Wars

As someone preparing to enter this space, I’ve stopped looking at drones as flying cameras. They’re part of a broader shift in how nations defend themselves without firing first.

The next wave of war will be silent:

- Loitering munitions with AI-assisted targeting

- Swarm UAVs that don’t need instructions

- Counter-drone systems that react in microseconds

- Defence OS that works across land, air, and beyond

With the growing size of India’s drone market and the government’s expanded $234 million incentive, the stakes have changed. But the invisible stack—secure OS, cryptographic navigation, resilient comms—is still missing.

No country can call itself secure if it depends on foreign‑made navigation chips, insecure telemetry links, or generic software platforms.

This is why the drone defence market in India can’t just fly—it must think, fight, and defend.

Discover more from WireUnwired Research

Subscribe to get the latest posts sent to your email.