Key Insights

- Humanoid robots are rapidly reshaping Korean manufacturing, with major industry and government investments driving adoption.

- Boston Dynamics’ Atlas, Tesla’s Optimus, and BMW’s Figure 02 robots are being deployed in US and Korean factories, signaling global market acceleration.

- The Korean government’s ‘K-Humanoid Alliance’ and $700M+ investment aim to foster domestic innovation and capture a share of the projected $5 trillion global market by 2050.

Humanoid Robots Hit Korean Factory Floors: A New Era for Physical AI

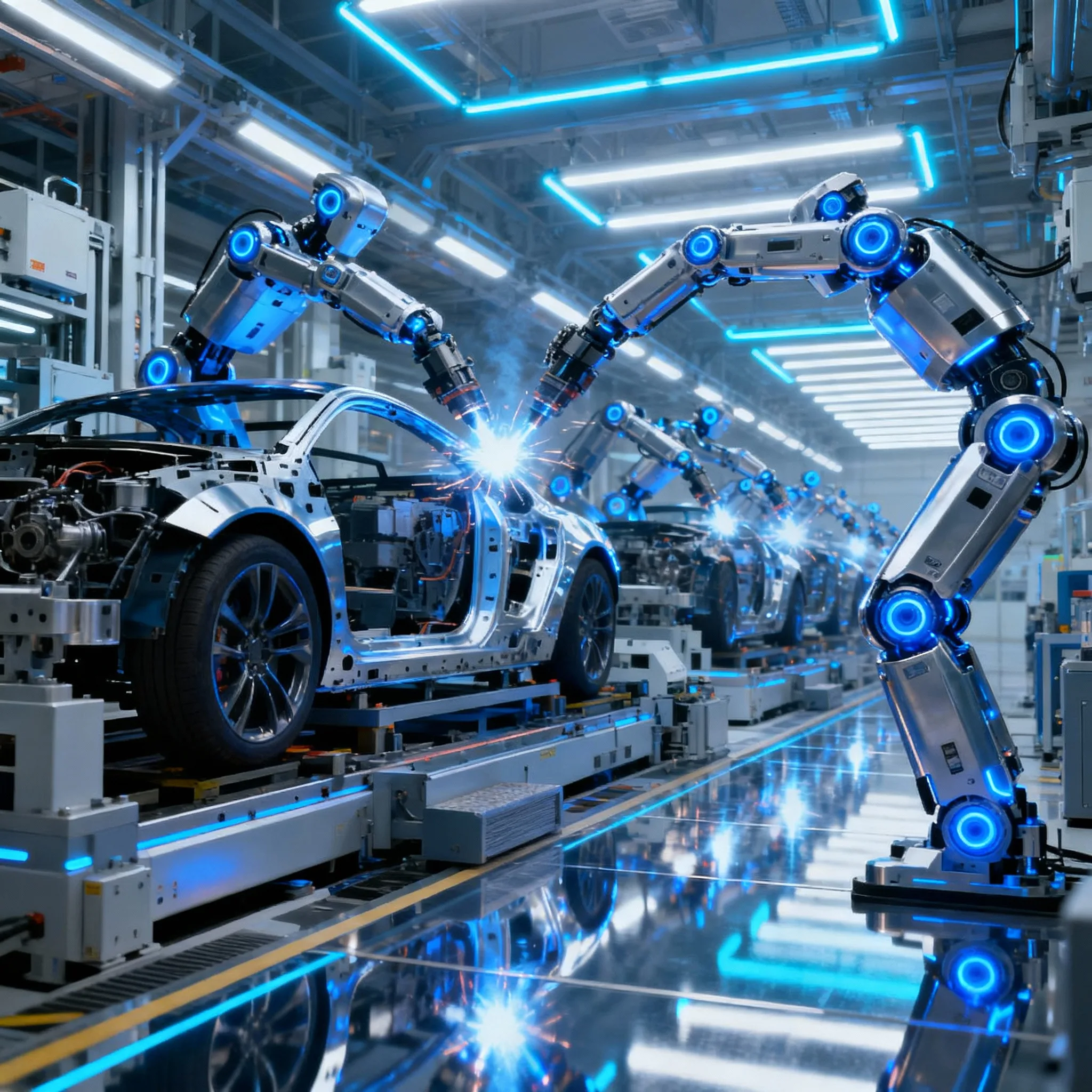

Korean manufacturers are embracing a new wave of automation as humanoid robots begin to populate factory floors—reshaping production lines and signaling a pivotal shift for the industry. The deployment of advanced robots such as Boston Dynamics’ Atlas at Hyundai’s Georgia EV plant this October marks a milestone in physical AI, as robots take on complex tasks like parts sequencing and precision assembly previously reserved for human hands.

Also Read :Physical AI Echoes at AI Horizons 2025: How Carnegie Mellon Is Advancing Real-World Robotics

K-Humanoid Alliance: Korea’s Push for Domestic Robotics Leadership

To accelerate this technological leap, the Korean government has launched the K-Humanoid Alliance, a consortium of 40 companies and academic institutions dedicated to developing fully sovereign humanoid robots built on domestic technology. Backed by over $713 million in planned investments through 2030, this initiative aims to position Korea as a global leader in humanoid robotics, with industry optimism bolstered by falling manufacturing costs and rapid improvements in reliability.

Global Surge: Boston Dynamics, Tesla, BMW Scale Up Humanoid Robot Integration

The race is not limited to Korea. Boston Dynamics—backed by Hyundai Motor—will deploy its Atlas robot at Hyundai’s US plant, while Tesla has introduced its Optimus humanoid robot at the Fremont factory in California, aiming for around 1,000 units by year-end. Tesla CEO Elon Musk projects that Optimus could eventually account for 80% of the company’s value, with a target price of $20,000 per unit. Meanwhile, BMW’s South Carolina plant now features Figure 02 robots from Figure AI, which can handle up to 1,000 tasks daily, boasting a fourfold speed increase and sevenfold reliability improvement over earlier models.

Cost, Safety, and Market Potential: Industry Reactions and Analyst Perspectives

Industry analysts in Korea express both excitement and caution. The promise of significant cost savings and enhanced safety drives enthusiasm, but concerns linger about high upfront costs and the reliability of these robots. Nevertheless, manufacturing expenses for humanoids are falling rapidly; lower-end models have dropped 40% in price in just one year, far outpacing expectations. Goldman Sachs predicts faster commercialization ahead.

As physical AI takes on hazardous and dirty jobs, such as Posco DX’s unmanned AI crane for steel mills, the operational burden on human workers is eased, and safety is improved. Morgan Stanley forecasts the global humanoid robot market could exceed $5 trillion by 2050, with shipments rising from 13 million units in 2035 to over 1 billion by the 2050s—over 90% destined for industrial and commercial use.

South Korea’s Competitive Edge: Building the Future of Automation

With the K-Humanoid Alliance and robust government support, Korea is poised to compete globally in the fast-expanding humanoid robotics sector. Major manufacturers and startups alike are racing to innovate, leveraging AI-driven automation to boost productivity, reduce costs, and transform hazardous work environments. As the market surges toward multi-trillion-dollar potential, Korea’s early investments and strategic alliances may prove decisive in shaping the future of industrial automation.

Discover more from WireUnwired Research

Subscribe to get the latest posts sent to your email.